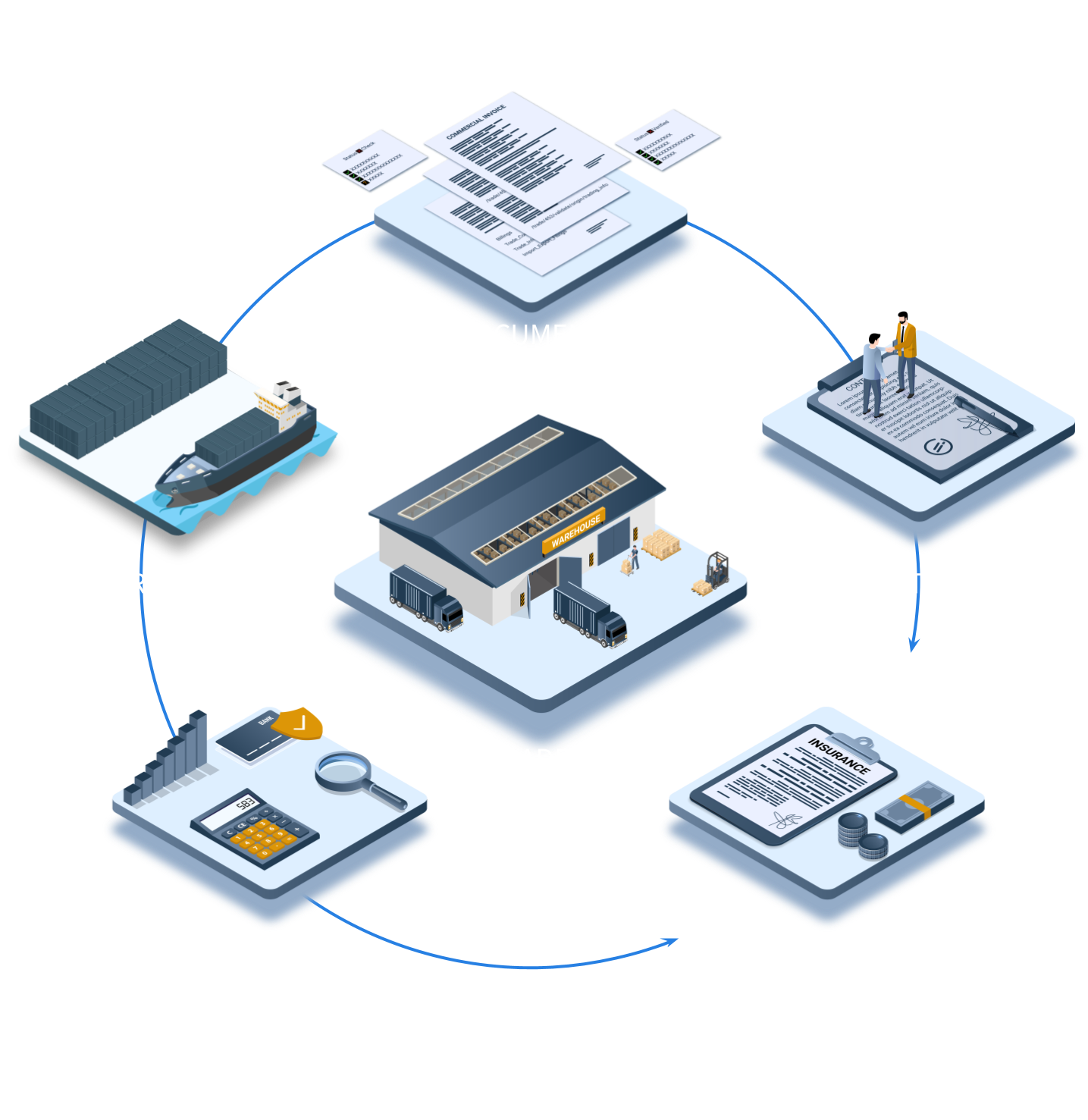

Who we serve

Traders

Supply chain and shipping teams at manufacturers, distributors, wholesalers, and any business transporting physical goods across borders.

Trade Enablers

The essential service network that powers international commerce: forwarders, customs brokers, banks, insurers, inspection agencies, importers of record, and more.

Interface seamlessly

Connect via API with Cargowise and other leading industry platforms

OR get started immediately with simple CSV uploads or our powerful Document Ingestor

Rapidly deploy

No need for lengthy consultancy

Get going immediately with built-in implementation guides or use our simple onboarding options

Data security and privacy

Exchange sensitive commercial information with confidence

Our secure sharing infrastructure ensures documents are never lost while maintaining privacy

Document ingestor

Painless and simple data capture from any document or scan

With our document and filing widget, minimal data entry or interfacing is required. Get going instantly.

Upload one-by-one or upload many documents in one go. Filings can be created in minutes.

For forwarders and brokers, embed on your website for a seamless entry to your workflow.

Integrated with all our existing tooling, market data checks and AI models for accuracy.

All data is held securely according privacy policy.